India’s fastest growing online investment advisory platform Kuvera, today announced the addition of ‘Digital Gold’ and ‘Digital Gold SIP’ – a convenient, secure and practical approach to diversifying one’s investments by including gold as part of the portfolio.

Digital gold purchased through Kuvera is backed by 24K 99.9% pure gold. Kuvera has tied up with Augmont, India’s leading gold platform to bring this service to its clients. Physical gold is stored in secure Brinks vaults and are monitored by an independent third party. Liquidation is easy and available at the click of a button. Gold balance can be sold partially or in whole almost immediately and at the then market price. The sale amount gets deposited electronically into the investor’s bank account making it completely digital and completely secure.

Highest purity 24K 99.9% purity

100% secure Secured in bank grade lockers by Brinks, a global security leader

Liquid Sell anytime. Receive payment in your bank account

Gold via Augmont Kuvera partners with Augmont, India’s leading gold platform

|

Gaurav Rastogi, CEO of Kuvera said, “Gold is unique among commodities due to its traditional role as a safe-haven and ‘store’ of value. Gold returns have low correlation to equity returns especially during adversity. Through Digital Gold, Kuvera helps users to bridge the gap of owning gold and safekeeping physical gold; while ensuring quick liquidity, transparency and ease of transactions. Similarly, with Digital Gold SIP we want to make accumulation of gold over time as easy as mutual fund units. We are constantly in the process of reimagining investment opportunities for our discerning users and believe this is another step towards portfolio diversification.”

Kuvera was founded in 2016 as India’s first ‘free-to-use’ web-based direct mutual fund investment platform. It provides more than 5 lakh investors with access to a range of innovative investment tools designed to help them save and reach their financial goals and has almost INR 7,000 crores mutual fund assets under advice.

Kuvera is also the first platform that enabled users to easily switch from regular mutual funds to direct mutual funds, lowering the cost of investing. Innovative features such as family login, mutual fund portfolio consolidation make Kuvera relevant for both advanced users and first timers.

More Details on the Kuvera Blog: kuvera.in/blog/digital-gold-for-smart-investors.

About Kuvera

Kuvera is a SEBI registered online investment advisor that pioneered goal based, direct plan mutual fund investing for Indians. It uses technology to helps its users make smart investing decisions and navigate the nuances of mutual fund investing. Trusted by more than 3 lakh investors, it enables access to mutual fund schemes of 37 fund houses. Kuvera’s vision is to be the personal finance platform that individuals trust and love to use. www.Kuvera.in.

Follow the news stories on Kuvera here.

Why Invest in Digital Gold? (over Gold ETF and Gold Mutual Funds)

It is a known fact that Gold ETFs and Gold Mutual Funds do not track the price of physical gold closely. The culprit is fund expenses.

The NAV for Gold ETF or Mutual Funds is computed after deducting the fee of the asset management company plus storage and custodian charges, which can all add up. Over time this can create a significant mismatch in gold returns and that of the gold ETF or Mutual Fund.

Why invest in digital gold (over physical gold)?

Purity Certified 24K 99.9% pure gold. As good as it gets.

Security – Stored in vaults by BRINKS, the global leader in asset security. No theft issues, no bank lockers, nada.

Access – Sell it online at the prevailing gold price for immediate cash or request for home delivery. Your gold, your way.

Quantity – Pay only for gold. No making charges, cuts or commissions. Get more gold.

Buy it when you want to invest in gold and sell it when you need money – all from the comfort of our app. Digital gold, thus, overcomes some of the traditional challenges of investing in gold.

Why invest in digital gold (along with equity MFs)?

Going back to 1990 and looking at monthly data we can see that Nifty50 returned higher on average, but with higher standard deviation or risk. Risk-adjusted returns are still marginally better for gold but not by much. Gold however adds great diversification benefits.

In the past 29 years of data, the correlation of monthly gold returns and monthly Nifty50 returns is just 0.3% while returning a very respectable 10.7% a year!

Of the 348 monthly returns in our sample, there are 178 instances where the returns on gold and returns on Nifty 50 have opposite signs. That is if gold posted positive returns, Nifty 50 posted negative returns and vice versa. This is exactly what diversification is about – two assets, each with positive expected returns but no correlation in returns.

It helps you tide over the bad times much better. Or you could say, when the going gets tough, gold gets going.

Two quick examples:

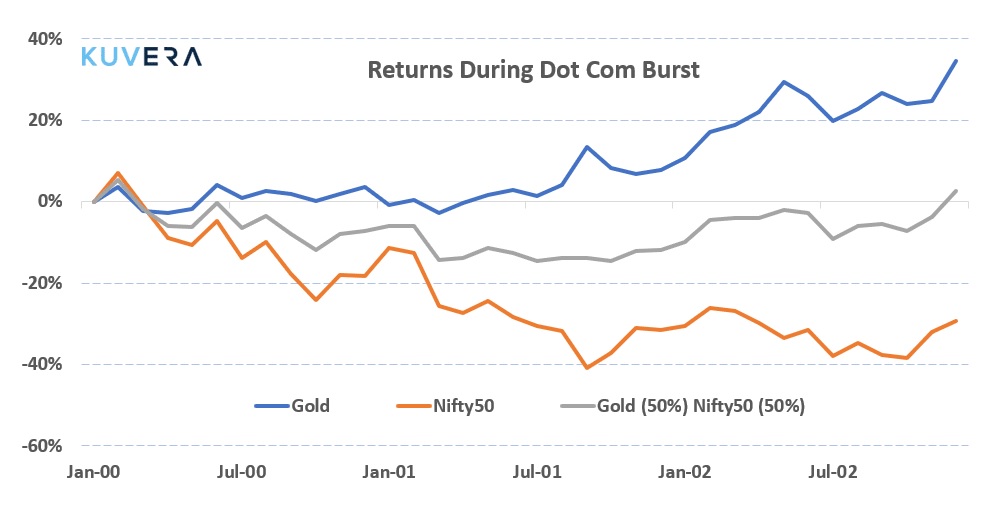

The dot com burst of 2000 – 2002:

|

Returns during Dot com Burst

The Global Financial Crisis of 2008:

|

Returns during Financial Crisis

For a detailed blog on the subject, please click here.